About in claim-paying capacity

When it comes to financial strength, California Earthquake Authority (CEA) is on solid ground:

- Largest provider of residential earthquake insurance in the U.S.

- Provides two-thirds of the residential earthquake insurance policies sold in California.

- Annual premium revenue about .

- About in claim-paying ability.

CEA's financial strength has been rated as B++ (Good) since 2023 by A.M. Best Co., the world's oldest and most authoritative rating agency of insurance companies.

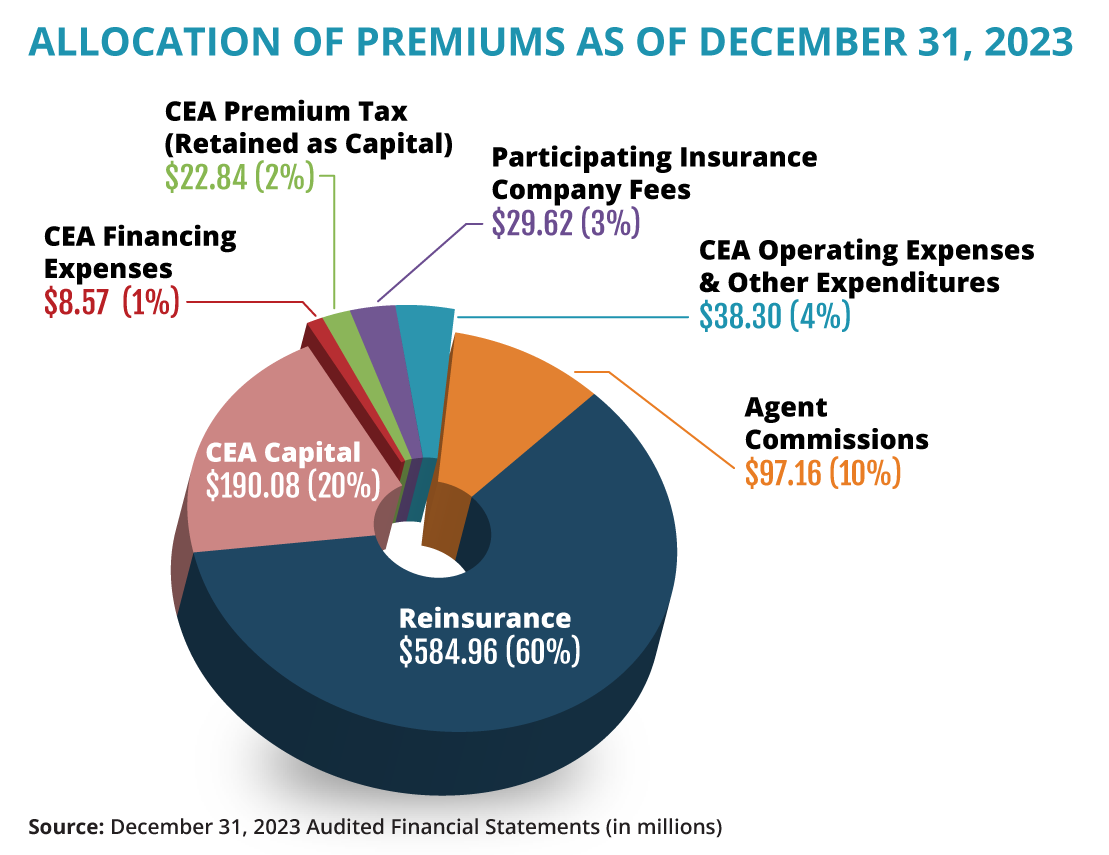

Where does a premium dollar go?

Most of the funds CEA collects from premiums are reinvested into the business of insuring policyholders, not overhead. By law, only 6 percent of CEA's premium income can be spent on operating expenses.

- See CEA Financial Statements for more information.

CEA is not-for-profit, privately funded

CEA is a not-for-profit, privately funded, publicly managed organization that provides residential earthquake insurance and encourages Californians to reduce their risk of earthquake loss.

- CEA only offers residential insurance.

- Our assets are available only to pay claims to homeowners and renters who have protected their homes by purchasing a CEA earthquake policy.

- As a not-for-profit, CEA does not pay federal income tax, so our reserves used to cover claims can grow more quickly.

- CEA is actuarially sound, which means we have been deemed by financial experts to have sufficient funds—about —to pay claims from even a devastating earthquake.